As a parent, your child’s well-being is your utmost priority. From their education to their dreams and aspirations, you want to ensure a secure future for them. One of the key ways to safeguard their future is by investing in a child insurance plan. In this blog post, we will explore everything you need to know about a child insurance plan and how it can provide financial protection and support for your child’s future endeavors.

Understanding Child Insurance Plans

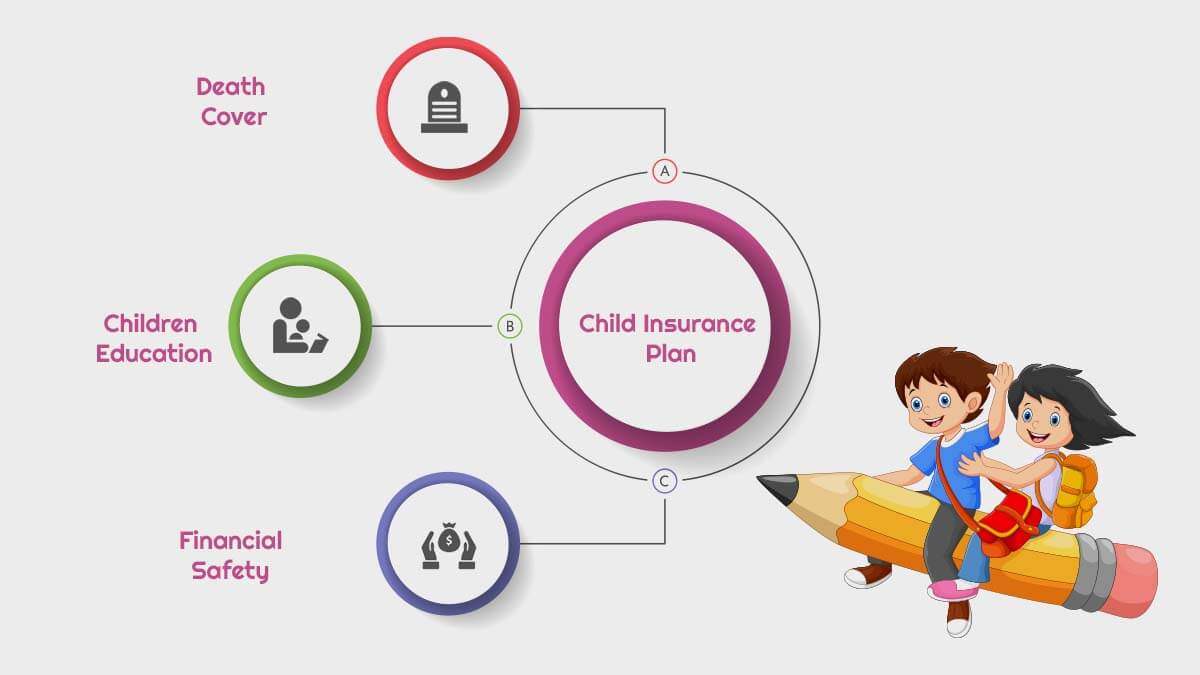

A child insurance plan is a specialized insurance policy designed to secure a child’s future financially. It acts as a protective shield, ensuring the financial well-being of your child even in your absence. These plans offer a combination of life insurance and investment components, providing not only a life cover but also a savings component to build a corpus for future needs.

A child insurance plan is a specialized insurance policy designed to provide financial protection and security for your child’s future. It combines the benefits of life insurance and investment components, ensuring that your child’s needs are met even in your absence.

The primary objective of a child insurance plan is to offer financial support and stability for your child. In the unfortunate event of your demise, the plan provides a lump sum payout or regular income to cover your child’s education, healthcare, and other essential needs. It acts as a safety net, ensuring that your child’s future remains secure.

Education is one of the most significant expenses parents face. Child insurance plans help you plan for your child’s education by building a corpus over time. By starting early and making regular premium payments, you can accumulate a substantial amount by the time your child reaches college or university. This fund can be used to cover tuition fees, study abroad expenses, or any other educational needs.

Flexibility and customization options are key features of child insurance plans. You can choose the policy term, premium payment frequency, and sum assured based on your financial goals and affordability. Some plans even offer the flexibility to withdraw partial amounts at specific milestones in your child’s life, such as higher education or marriage.

Child insurance plans not only provide financial protection but also offer an opportunity for savings and wealth creation. These plans usually have an investment component that allows you to accumulate savings through disciplined premiums. The funds are invested in various financial instruments, such as equity, debt, or balanced funds, depending on your risk appetite and financial goals.

Furthermore, child insurance plans offer tax benefits under the prevailing tax laws. The premiums paid towards the policy are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the maturity or death benefits received are generally tax-free under Section 10(10D) of the Act, subject to specific conditions.

When considering a child insurance plan, it’s important to assess factors such as the reputation of the insurance provider, claim settlement ratio, policy charges, surrender value, and coverage options. Comparing multiple plans, reading the terms and conditions carefully, and seeking expert advice can help you make an informed decision.

In conclusion, a child insurance plan is a valuable tool for securing your child’s future. It provides financial protection, supports their education and career goals, and offers peace of mind to parents. By choosing the right plan and starting early, you can build a strong financial foundation for your child, ensuring that they can pursue their dreams without any financial constraints.

Financial Protection and Security

The primary objective of a child insurance plan is to provide financial protection and security for your child. In the unfortunate event of your demise, the plan ensures that your child’s education, healthcare, and other essential needs are taken care of. It acts as a safety net, offering a lump sum payout or regular income to the child to fulfill their requirements.

Financial protection and security are crucial aspects of a child insurance plan. These plans are specifically designed to provide a safety net for your child’s future, ensuring their financial well-being even in challenging circumstances. Here’s how child insurance plans offer financial protection and security:

- Life Cover: Child insurance plans offer a life cover component, which means that in the event of the parent’s demise, the child will receive a lump sum payout or regular income. This financial support helps the child meet their immediate and long-term needs, such as education expenses, healthcare costs, and daily living expenses.

- Continuity of Education: Education is a significant aspect of a child’s future. In case of an unfortunate event leading to the parent’s death or disability, child insurance plans provide financial assistance to ensure the child’s education continues uninterrupted. The funds received from the plan can be used to pay for school fees, tuition, books, and other educational expenses.

- Mitigating Financial Risks: Child insurance plans help mitigate financial risks by offering a layer of protection against unforeseen circumstances. Whether it’s a critical illness, disability, or loss of income, these plans provide financial support to ensure that your child’s lifestyle and opportunities are not compromised.

- Savings and Investment Component: Child insurance plans often come with an investment component, allowing you to build a corpus over time. These plans offer the potential for wealth creation by investing premiums in various financial instruments such as equities, bonds, or mutual funds. The accumulated savings can be utilized for your child’s future needs, such as higher education, starting a business, or purchasing a home.

- Tailored Benefits: Child insurance plans are customizable to meet your specific requirements. You can choose the sum assured, policy term, premium payment frequency, and other features based on your financial goals and affordability. This flexibility allows you to design a plan that aligns with your child’s future aspirations and provides adequate financial protection.

- Tax Benefits: Child insurance plans often offer tax benefits, providing additional savings. The premiums paid towards the plan may qualify for tax deductions under relevant sections of the Income Tax Act. Additionally, the maturity or death benefits received are generally tax-free, subject to certain conditions.

In summary, a child insurance plan ensures financial protection and security for your child’s future. It provides a life cover, helps maintain continuity of education, mitigates financial risks, offers savings and investment opportunities, and comes with tax benefits. By securing your child’s financial well-being, these plans provide peace of mind and enable them to pursue their dreams without financial constraints.

Education and Career Support

One of the most significant expenses parents face is the cost of education. A child insurance plan helps you plan for your child’s education and career aspirations. By starting early and making regular premium payments, you can accumulate a substantial corpus by the time your child reaches college or university. This fund can cover tuition fees, study abroad expenses, or any other educational needs.

Education and career support are significant aspects of a child insurance plan. These plans are designed to help parents prepare financially for their child’s education and future career endeavors. Here’s how child insurance plans offer education and career support:

- Education Fund: One of the primary goals of a child insurance plan is to assist parents in building a dedicated education fund for their child. By starting early and making regular premium payments, parents can accumulate a substantial corpus over time. This fund can be utilized to cover educational expenses such as school fees, college tuition, books, supplies, and other related costs.

- Flexibility in Withdrawals: Some child insurance plans offer the flexibility to withdraw partial amounts at specific milestones in the child’s life. For example, when the child reaches higher education or career-related milestones, such as pursuing professional courses or starting a business. This allows parents to provide financial support at crucial junctures in their child’s educational and career journey.

- Study Abroad Support: Child insurance plans can also assist in financing study abroad opportunities. Many plans offer the option to withdraw funds or avail loans against the policy to cover expenses related to overseas education. This feature provides parents with the means to support their child’s international educational aspirations.

- Skill Development and Vocational Training: In addition to traditional education, child insurance plans can be utilized to fund skill development programs or vocational training courses. This ensures that the child has access to diverse educational opportunities that align with their interests and career goals.

- Career Protection: Child insurance plans offer a layer of protection for the child’s future career. In the unfortunate event of the parent’s demise or disability, these plans provide financial support to ensure the child can continue pursuing their chosen career path. The funds received can help cover training costs, professional certifications, or even support the child in establishing their own business.

- Comprehensive Financial Planning: Child insurance plans encourage comprehensive financial planning for the child’s education and career. These plans serve as a reminder to parents to set specific financial goals and allocate resources accordingly. By factoring in educational expenses and long-term career aspirations, parents can better plan and save for their child’s future needs.

In conclusion, child insurance plans provide education and career support by helping parents build an education fund, offering flexibility in withdrawals, supporting study abroad opportunities, financing skill development programs, and providing career protection. By incorporating these features, these plans assist parents in securing a strong financial foundation for their child’s education and future career endeavors

Flexibility and Customization

Child insurance plans come with various customization options to suit your specific requirements. You can choose the policy term, premium payment frequency, and sum assured based on your financial goals and affordability. Some plans also offer the flexibility to withdraw partial amounts at specific milestones in your child’s life, such as higher education or marriage.

Savings and Wealth Creation

Apart from providing financial protection, child insurance plans allow you to build wealth over time. These plans usually have an investment component that helps you accumulate savings through disciplined premiums. The funds are invested in various financial instruments like equity, debt, or balanced funds, depending on your risk appetite and financial goals.

Tax Benefits

Child insurance plans also offer tax benefits under the prevailing tax laws. The premiums paid towards the policy are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the maturity or death benefits received are generally tax-free under Section 10(10D) of the Act, subject to specific conditions.

Tax benefits are an important aspect of child insurance plans. These plans offer certain advantages under the prevailing tax laws, providing additional savings to policyholders. Here’s a closer look at the tax benefits associated with child insurance plans:

- Tax Deductions on Premiums: The premiums paid towards a child insurance plan may qualify for tax deductions under Section 80C of the Income Tax Act, subject to the overall limit of the section. Currently, the maximum deduction allowed under Section 80C is ₹1.5 lakh per financial year. By including the premiums paid for a child insurance plan in your overall 80C deductions, you can reduce your taxable income.

- Tax-Free Maturity or Death Benefits: The maturity or death benefits received from a child insurance plan are generally tax-free under Section 10(10D) of the Income Tax Act. This means that the amount received on maturity or in the event of the parent’s demise is exempt from tax in the hands of the policyholder or the nominee, subject to certain conditions. This tax exemption ensures that the funds received from the plan can be utilized entirely for the child’s financial needs without any tax implications.

- Wealth Accumulation and Capital Gains Tax: Child insurance plans often have an investment component that allows policyholders to accumulate wealth over time. Any capital gains earned through the investment component of the plan may attract capital gains tax as per the prevailing tax rules. It’s important to note that the tax treatment of capital gains depends on the specific financial instruments in which the funds are invested.

- Gift Tax Exemption: In some cases, child insurance plans can also be used as a gifting option for your child. Premium payments made by parents or other family members for the child’s policy may be considered as gifts. However, as per the current tax laws in India, gifts received by individuals from specified relatives, including parents, are exempt from gift tax.

It’s essential to consult a tax advisor or financial expert for specific details regarding the tax benefits applicable to child insurance plans. They can guide you on how to optimize these benefits based on your individual circumstances and the prevailing tax regulations.

In conclusion, child insurance plans offer tax benefits such as deductions on premiums under Section 80C, tax-free maturity or death benefits under Section 10(10D), potential capital gains tax implications, and gift tax exemptions. These tax advantages make child insurance plans an attractive option for parents looking to secure their child’s future while enjoying tax savings.

Factors to Consider

Before choosing a child insurance plan, it’s essential to consider factors such as the reputation of the insurance provider, claim settlement ratio, policy charges, surrender value, and coverage options. It’s advisable to compare multiple plans, read the terms and conditions carefully, and seek expert advice if needed.

When considering a child insurance plan, it’s important to take several factors into account. These factors can help you choose the most suitable plan that aligns with your financial goals and provides comprehensive coverage for your child’s future. Here are some key factors to consider:

- Reputation and Track Record: Research the reputation and track record of the insurance provider offering the child insurance plan. Look for a reputable and financially stable company with a good claim settlement ratio. A reliable provider ensures that your child’s financial future is in safe hands.

- Coverage Options: Evaluate the coverage options offered by different plans. Consider the scope of coverage, including life cover, critical illness benefits, and disability coverage. Assess the extent to which the plan safeguards your child’s financial well-being in various scenarios.

- Premiums and Affordability: Consider the premium amount you need to pay for the child insurance plan. Assess whether it is affordable and fits within your budget. Compare premiums across different plans to find a balance between coverage and cost.

- Policy Charges and Fees: Understand the various policy charges and fees associated with the plan, such as administration fees, premium allocation charges, surrender charges, and fund management charges. Be aware of any potential charges that might affect the overall value of the plan.

- Policy Terms and Flexibility: Examine the policy terms and conditions, including the policy term, premium payment frequency, and flexibility in adjusting coverage or modifying the plan. Look for plans that offer flexibility to adapt to changing circumstances and financial goals.

- Surrender Value and Partial Withdrawals: Familiarize yourself with the surrender value of the policy and the conditions under which you can make partial withdrawals from the plan. This can be useful in case you need access to funds at certain milestones in your child’s life.

- Additional Riders and Benefits: Explore any additional riders or benefits available with the child insurance plan. These may include options for accelerated critical illness coverage, premium waivers, or educational fund boosters. Assess whether these features enhance the overall coverage and align with your specific needs.

- Policy Documentation and Terms: Carefully review the policy documentation, terms, and conditions. Ensure that you understand the policy’s inclusions, exclusions, waiting periods, and claim settlement processes. Seek clarification from the insurance provider or a financial advisor if any aspects are unclear.

- Expert Advice: Consider seeking advice from a financial advisor or insurance expert who can provide insights based on your specific circumstances and goals. They can help you navigate through the various options and recommend the most suitable child insurance plan for your needs.

By considering these factors, you can make an informed decision while selecting a child insurance plan that provides comprehensive coverage and meets your child’s future financial requirements.

Conclusion

Investing in a child insurance plan is a crucial step towards securing your child’s future. It offers financial protection, supports their education and career goals, and provides peace of mind to parents. By starting early and choosing the right plan, you can ensure a strong financial foundation for your child, allowing them to pursue their dreams without any financial constraints. Remember to assess your needs, research the available options, and consult a financial advisor to make an informed decision.